Angel Rubio — arubio@urnerbarry.com

Andrei Rjedkin — arjedkin@urnerbarry.com

The cage-free wave has been strong within recent years. Growing consumer preference along with corporate and legislative efforts have resulted in increased support for cage-free egg products and producers have altered operations to accommodate demand. Several states have even banned the sale of conventionally-produced eggs, adding further support to this growing segment.

California’s Proposition 12 requires shell and liquid eggs sold in the state to come from egg layers housed in cage-free systems. This law went into full effect on January 1, 2022, and similar restrictions are soon to come in other states. As a result, aside from the current logistical issues in our economy, enforced transitions to a new cage-free standard may establish new price levels for the jurisdictions that abide by them.

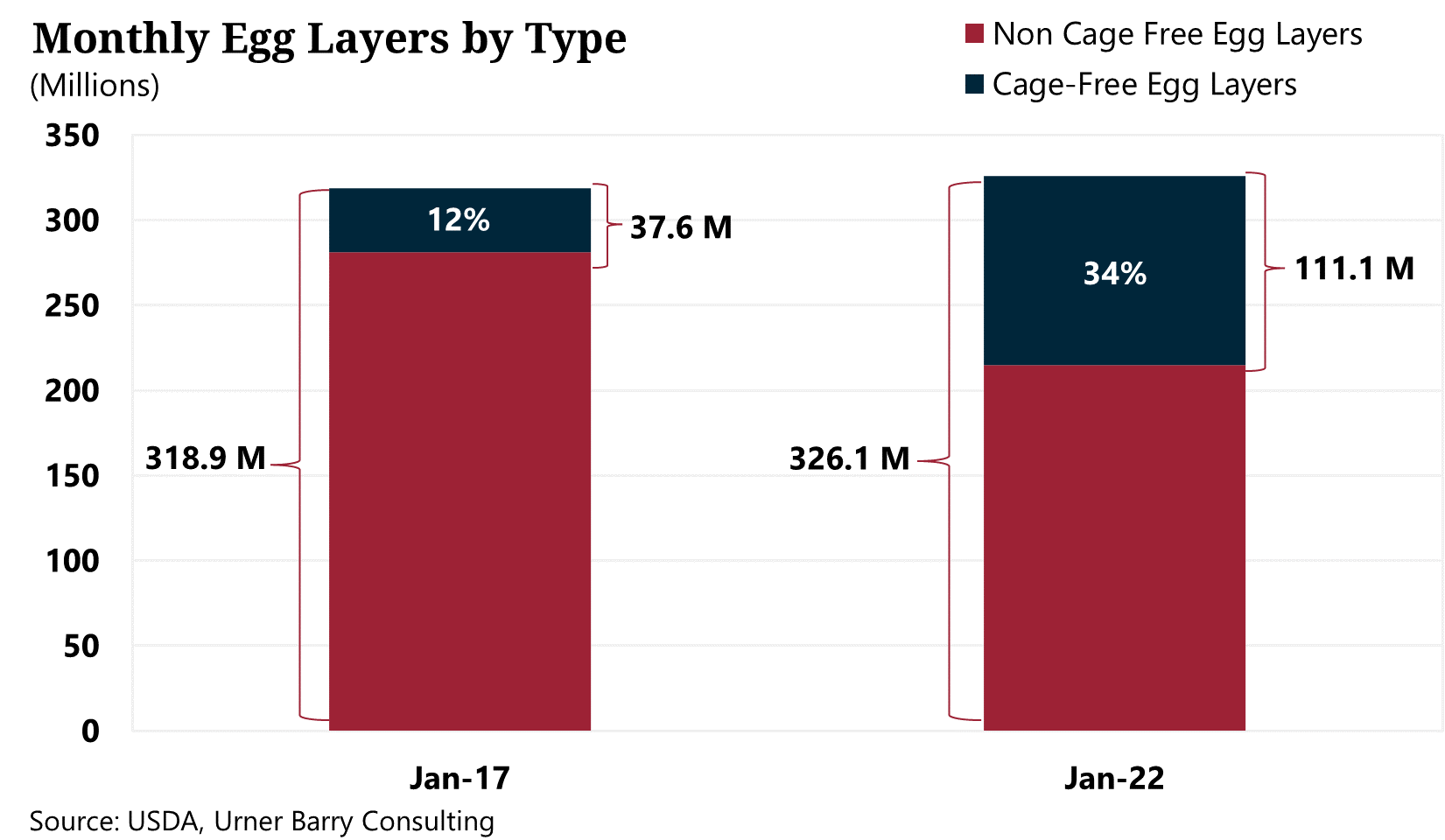

At the producer level, operations have already been adjusting. According to the USDA, in January 2017, the United States had 318.9 million egg layers, of which 37.6 million were cage-free—which equated to 12 percent of the market. By January 2022, cage-free layers increased to 111.1 million, representing 34 percent of the market—nearly a 200 percent increase from 2017.

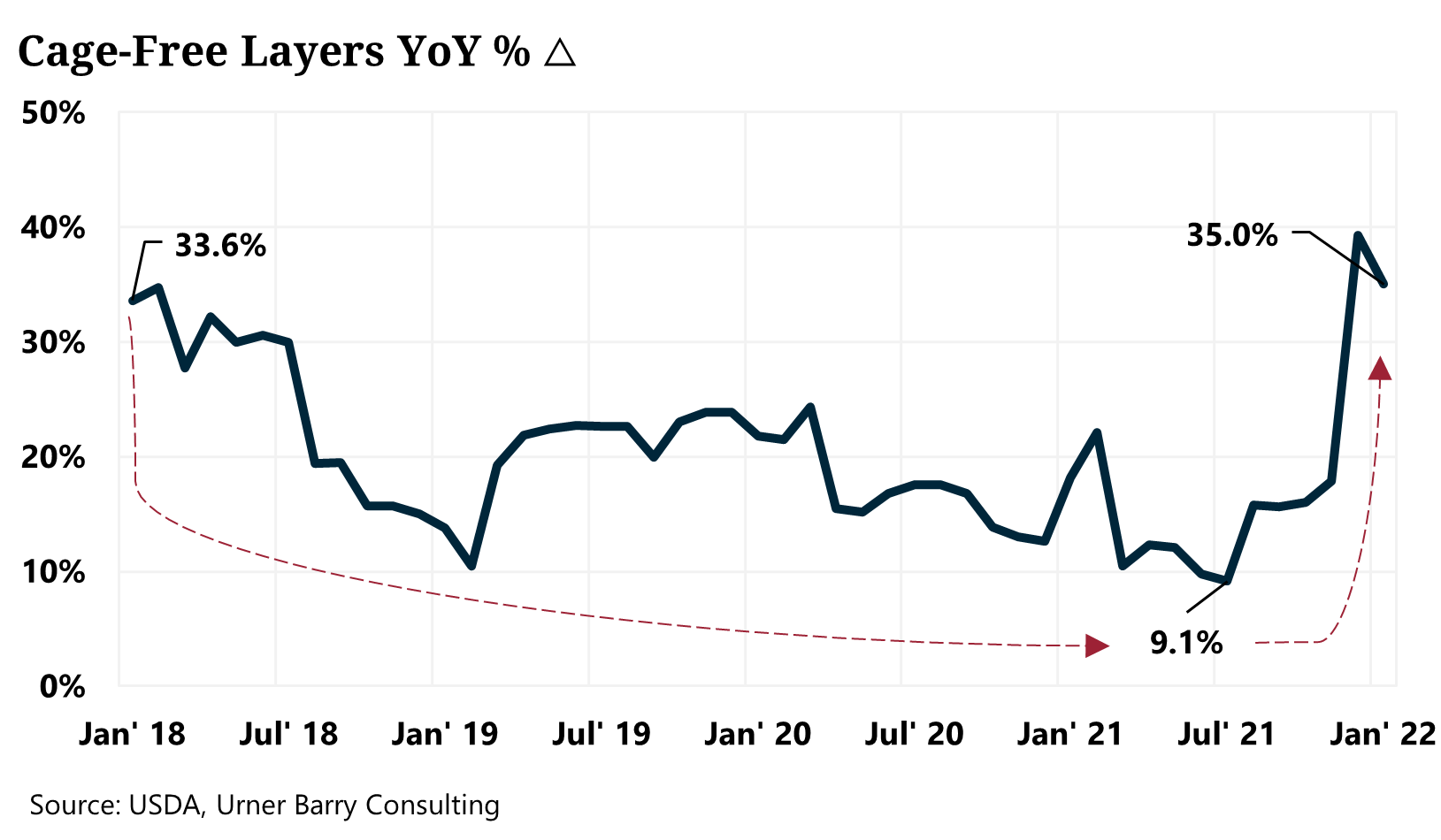

While still increasing, the rate at which cage free-layers were added to the market slowed from January 2018 to mid-2021. The year-over-year monthly growth rate was 33.6 percent in January 2018, dropping to 9.1 percent in July 2021. Recently, however, we have seen a sharp increase, most likely due to cage-free mandates going into effect in 2022. In fact, January 2022 recorded a 35 percent increase in cage-free layers.

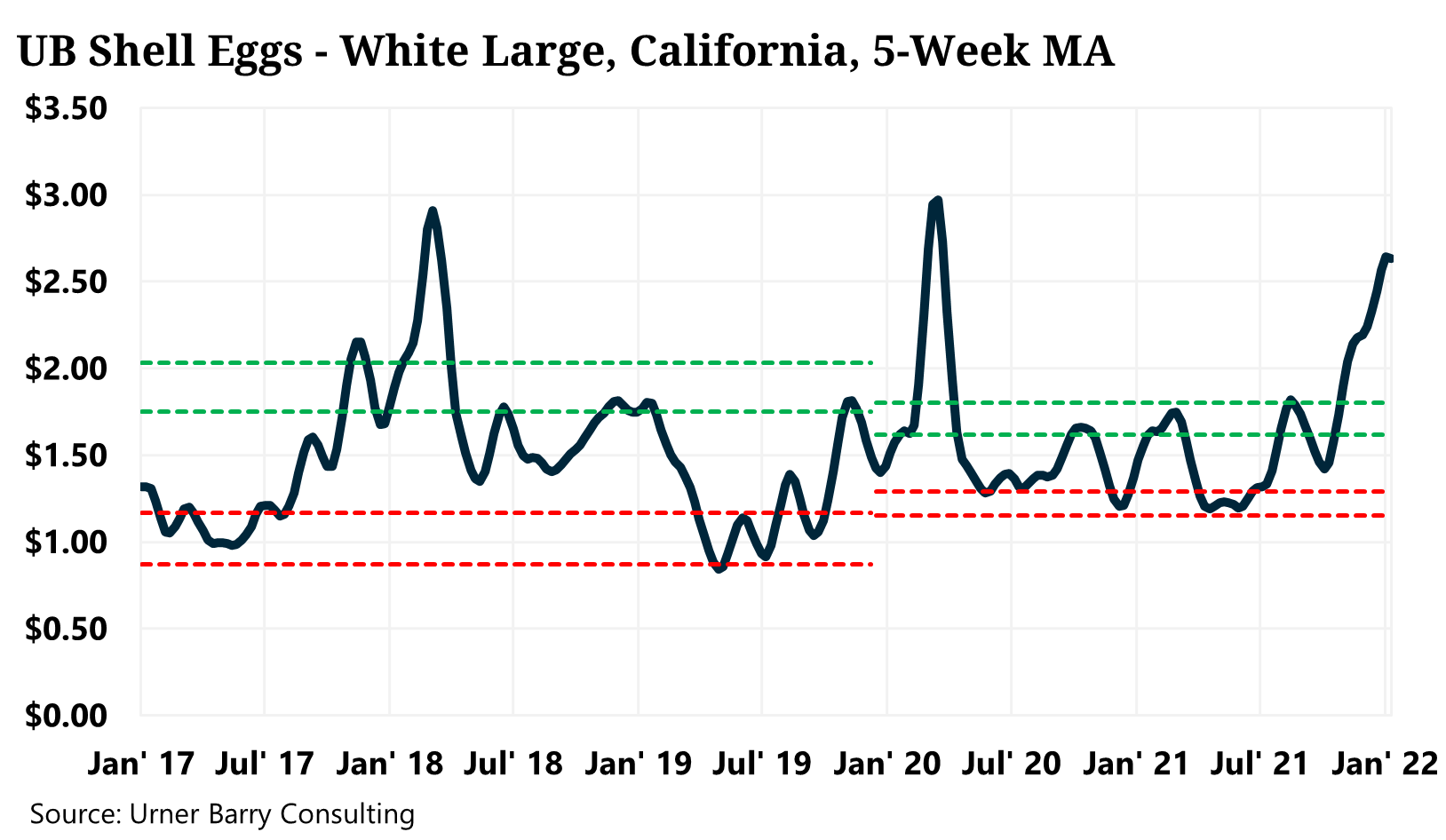

The Urner Barry California shell egg quote represents product that complies with state standards. From 2020 to 2022, the quote represented product from egg layers that required at least 144 square inches of floor space. Since the beginning of 2022, the quote now represents new standards. As mentioned previously, shell eggs must come from egg-laying hens housed in cage-free environments. From a price standpoint, the second-highest seasonal monthly nominal white large shell egg price was recorded in January 2022 at about $2.66 per dozen — roughly a 90 percent increase year-over-year.

After smoothing the data, we can make the case that the transition to cage-free in 2022 may shift both technical resistance and support levels to new degrees. Since mid-November 2021, prices have been trading above the 2nd technical resistance level. Technical support and resistance levels are calculations used by analysts and traders to determine certain thresholds in the price of an asset. Consistent prices above or below these levels could indicate a structural change in nominal prices going forward— something we may witness with the California shell egg market. In other words, prices could oscillate in this market at higher levels, despite following historical seasonal patterns.

At this stage, Urner Barry Consulting (UBC) remains vigilant as to where these new price levels may settle in the future. We have already seen a substantial shift in the growing amount of cage-free egg layers in the market. If mandates continue and prices remain relatively high compared to conventional shell eggs, as supply imbalances persist producers may be more incentivized to expand on cage-free infrastructure. As a result, we can expect price volatility in the short run as the market transitions. In the long term, and from a fundamental perspective, an increase in the supply of cage-free eggs would cause a drop in prices, holding all else equal.

The Urner Barry egg reporting team is currently collecting data on the wholesale cage-free egg trade. As more data is collected, UBC will look to add cage-free to their bi-weekly egg forecasting report.

Angel Rubio

Urner Barry

1-732-240-5330

arubio@urnerbarry.com

Andrei Rjedkin

Urner Barry

1-732-240-5330 ext 293

arjedkin@urnerbarry.com

Akash Pandey

Urner Barry

1-732-240-5330

apandey@urnerbarry.com