ANALYSIS: Turkey Production Headwinds

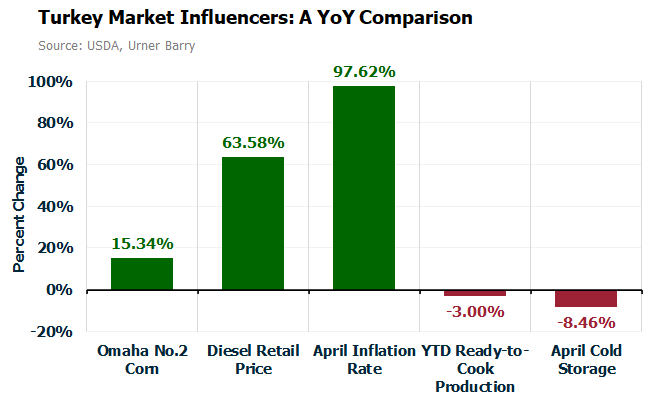

Thursday, 02 June 2022With mid-year now upon us and given the generally quiet but extremely robust trade environment post-Memorial Day, we thought it would be a great opportunity to check in on several components which continue to play a highly influential role on the market and its values. Although conversations revolving around the cost of feed have recently taken a back seat to other more pressing issues such as disease, it doesn’t take away from the fact that corn prices remain situated at some of the highest levels in recent history. At $8.12/bushel, one would have to venture all the way back to 2012 before stumbling upon only modestly steeper values. In terms of YoY (year-over-year) change, Omaha No.2 yellow corn is currently positioned 15.3% above this time last year and 72.7% above the 10-year seasonal average. This scenario is undoubtedly weighing heavy on the minds and in the wallets of players on the grow out side of the industry and is one major contributing factor to the subsequent uptick in spot valuation. You don’t have to be a poultry market participant to understand the implication of the second item on our list: fuel costs. In just the first four months of 2022, diesel retail prices have packed on an additional $1.40/gallon which equates to a 37.6% increase. When compared to this time in ’21, prices have risen by $1.99 or 65.6%. This has propelled values...

To continue reading, please visit COMTELL. Get full, premium analysis content from Urner Barry on the beef, pork, poultry, egg and seafood markets with COMTELL, the premier platform for commodity intelligence. Don't have COMTELL yet? Call 800-932-0617 to learn how you can gain access.

Dylan Hughes

Urner Barry

1-732-240-5330 ext 286

dhughes@urnerbarry.com